PEKANBARU, 19 May 2022 — Jikalahari urges the Attorney General’s Office and President Jokowi to also target financiers of palm oil giants Wilmar Group and Musim Mas Group, ranging from from the United States, Canada, Japan, China, Britain, Taiwan, Switzerland, Spain, South Korea, Singapore, Norway, Malaysia, Netherlands, Luxembourg, Italy, Germany, France, Finland, British Virgin Islands, Australia, Austria, Belgium, South Africa to Bermuda.

“This is to stop oil palm corporations from mixing up assets (money laundering) originating from corruption, environment and forest crime, as well as tax crime. They even committed human rights violations and contributed negatively to the climate,” said Made Ali, Jikalahari’s Coordinator.

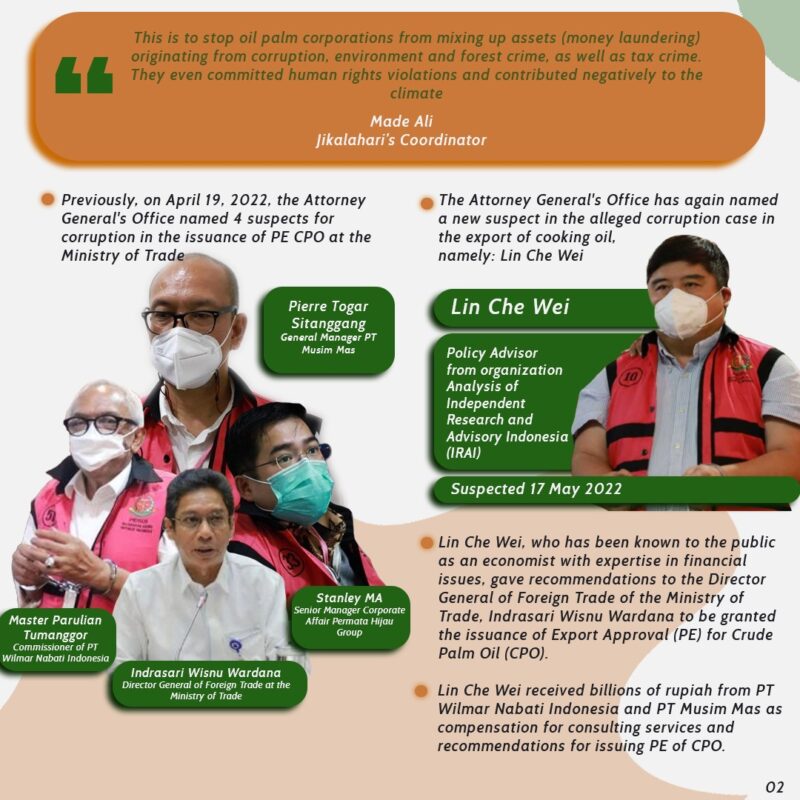

The Attorney General’s Office has again named a new suspect in the alleged corruption case in the export of cooking oil, namely: Lin Che Wei, Policy Advisor from organization Analysis of Independent Research and Advisory Indonesia (IRAI) on May 17, 2022. Lin Che Wei, who has been known to the public as an economist with expertise in financial issues, gave recommendations to the Director General of Foreign Trade of the Ministry of Trade, Indrasari Wisnu Wardana—who was named a suspect on April 19, 2022—to be granted the issuance of Export Approval (PE) for Crude Palm Oil (CPO). Lin Che Wei received billions of rupiah from PT Wilmar Nabati Indonesia and PT Musim Mas as compensation for consulting services and recommendations for issuing PE of CPO.

Previously, on April 19, 2022, the Attorney General’s Office named 4 suspects for corruption in the issuance of PE CPO at the Ministry of Trade, namely the Director General of Foreign Trade at the Ministry of Trade, Indrasari Wisnu Wardana, Master Parulian Tumanggor, Commissioner of PT Wilmar Nabati Indonesia, Stanley MA Senior Manager Corporate Affairs for the Permata Hijau Group and Pierre Togar Sitanggang, General Manager of PT Musim Mas.

The suspects communicated intensely with Indrasari to obtain export permits even though did not meet Domestic Market Obligation (DMO) provision requiring domestic distribution of at least 20% of total exports—and setting a different market price for the cooking oil. The required provisions since January are to overcome the scarcity of domestic cooking oil and not setting higher selling price for the public.

The suspects’ desire to export CPO is also reinforced by the skyrocketing world price of palm oil (CPO) since the beginning of 2022, which triggered the highest price of up to USD 2,010 per tonne on March 9, 2022 on the Rotterdam Commodity Exchange. This is a drastic increase from the price at the end of 2021 at USD 1,305 per tonne. “With the high CPO price, this export permit will certainly be very profitable for corporations. Everything is done to get a permit, even though it worsens the scarcity of cooking oil situation in the country,” said Made.

Jikalahari traced the sources of financing received by the palm oil business division of Wilmar and Musim Mas from 2013 to 2021 through the forestandfinance.org website on 18 May 2022.

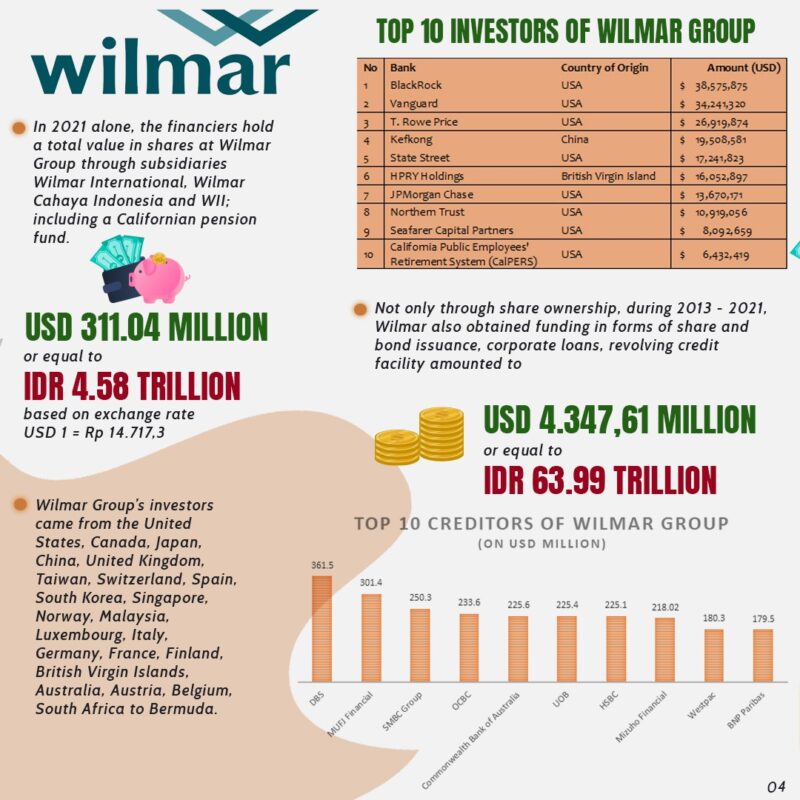

In 2021 alone, the financiers hold a total value of USD 311.04 million (based on today’s exchange rate) in shares at Wilmar Group through subsidiaries Wilmar International, Wilmar Cahaya Indonesia and WII; including a Californian pension fund.

Wilmar Group’s investors came from the United States, Canada, Japan, China, United Kingdom, Taiwan, Switzerland, Spain, South Korea, Singapore, Norway, Malaysia, Luxembourg, Italy, Germany, France, Finland, British Virgin Islands, Australia, Austria, Belgium, South Africa to Bermuda.

Table 1. Top 10 Investors of Wilmar Group

| No | Bank | Country of Origin | Amount (USD) |

| 1 | BlackRock | USA | $ 38,575,875 |

| 2 | Vanguard | USA | $ 34,241,320 |

| 3 | T. Rowe Price | USA | $ 26,919,874 |

| 4 | Kefkong | China | $ 19,508,581 |

| 5 | State Street | USA | $ 17,241,823 |

| 6 | HPRY Holdings | British Virgin Island | $ 16,052,897 |

| 7 | JPMorgan Chase | USA | $ 13,670,171 |

| 8 | Northern Trust | USA | $ 10,919,056 |

| 9 | Seafarer Capital Partners | USA | $ 8,092,659 |

| 10 | California Public Employees’ Retirement System (CalPERS) | USA | $ 6,432,419 |

Not only through share ownership, Wilmar also obtained funding in forms of share and bond issuance, corporate loans, revolving credit facility amounted to USD 4.347,61 million or equal. To IDR 63.99 trilllion (based on today’s exchange rate), during 2013 – 2021.

Graph 1: Top 10 Creditors of Wilmar Group

For Musim Mas Group, during 2013 – 2020, they received finances in the form of corporate loans and revolving credit facility amounted to USD 1,284 million or equivalent to 18.9 trillion (according to today’s exchange rate). These creditors include Rabobank (USD 551 million/ Rp 8.1 trillion), Groupe BPCE (USD 365.5 million/ Rp 5.38 trillion), HSBC (USD 282.5 million/ Rp 4.16 trillion), ING Group ( USD 59.3 million/ Rp 872.66 billion) and DBS (USD 25.6 million/ Rp 376 billion). The creditors for the Musim Mas Group are from the Netherlands, France, England and Singapore.

Table 2. Creditors of Musim Mas Group

| No | Bank | Negara | Jumlah (USD) | Jumlah (Rp) | Tipe Pendanaan |

| 1 | Rabobank | Belanda | $ 551,242,781 | Rp 8,112,805,380,811 | Kredit Bergulir |

| 2 | Groupe BPCE | Prancis | $ 365,461,940 | Rp 5,378,613,009,562 | Kredit Bergulir |

| 3 | HSBC | Inggris | $ 282,459,100 | Rp 4,157,035,312,430 | Kredit Bergulir |

| 4 | ING Group | Belanda | $ 59,294,940 | Rp 872,661,420,462 | Kredit Bergulir |

| 5 | DBS | Singapura | $ 25,550,400 | Rp 376,032,901,920 | Hutang |

| $ 1,284,009,161 | Rp 18,897,148,025,185 |

How will these corporations repay its debts?

Jikalahari suspects, it will not be sufficient to only rely on their legit business, free from crime. “Therefore, we suspect the profits that come from corruption, taxes and money laundering that they have carried out so far are also used to pay off debts to their financiers.

The Attorney General must expand its investigations, including writing or the financiers. This opportunity can be used by President Jokowi to improve the governance in palm oil financing to eliminate corruption and money-laundering. Countries of financiers’ origins should also review financing for the Wilmar and Musim Mas Groups provided by its financial services within their jurisdictions, and if possible stop or not extend financing for these two groups.

“The foreign financiers cannot turn a blind eye to their client’s blatant disregard of Indonesian law. These banks must respond decisively to this corruption and review whether they should continue financing these palm companies.” said Made Ali

Contact persons:

Made Ali, Jikalahari Coordinator—0812 7531 1009

Aldo, Campaign and Advocacy Officer—0812 6111 6340